Allianz Risk Barometer: Critical infrastructure blackouts top South Africa business risk for 2024

Submitted by: MyPressportal TeamCyber incidents such as ransomware attacks, data breaches, and IT disruptions are the biggest worry for companies globally in 2024, according to the Allianz Risk Barometer. The closely interlinked peril of Business interruption ranks second. Natural catastrophes (up from #6 to #3 year-on-year), Fire, explosion (up from #9 to #6), and Political risks and violence (up from #10 to #8) are the biggest risers in the latest compilation of the top global business risks, based on the insights of more than 3,000 risk management professionals.

Critical infrastructure blackouts top South Africa business risk for 2024

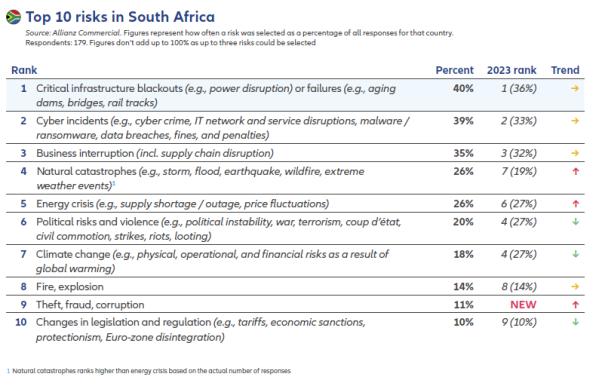

Critical infrastructure blackouts have emerged as the number one risk for businesses in South Africa for the second consecutive year highlighting the severe impact of power outages and the failure of essential infrastructure such as ports, railways, roads, and more on the economy and businesses. The closely interlinked peril of energy crisis has climbed to the fifth position, up from sixth place in 2023. Cyber incidents and business interruption continue to hold the second and third spots, respectively.

"South Africa's business community must remain vigilant in the face of critical infrastructure blackouts. The persistent threat of power outages and infrastructure failures poses significant challenges to businesses, disrupting supply chains, and impacting the overall economy. The report underscores the urgent need for investment in infrastructure resilience and the development of contingency plans to mitigate the potential consequences of blackouts. By proactively addressing these risks, businesses can enhance their ability to withstand disruptions and ensure continuity of operations,” said Thusang Mahlangu, CEO of Allianz Commercial South Africa.

Allianz Commercial CEO Petros Papanikolaou comments on the findings: “The top risks and major risers in this year’s Allianz Risk Barometer reflect the big issues facing companies around the world right now – digitalization, climate change and an uncertain geopolitical environment. Many of these risks are already hitting home, with extreme weather, ransomware attacks and regional conflicts expected to test the resilience of supply chains and business models further in 2024. Brokers and customers of insurance companies should be aware and adjust their insurance covers accordingly.”

Large corporates, mid-size, and smaller businesses are united by the same risk concerns – they are all mostly worried about cyber, business interruption and natural catastrophes. However, the resilience gap between large and smaller companies is widening, as risk awareness among larger organizations has grown since the pandemic with a notable drive to upgrade resilience, the report notes. Conversely, smaller businesses often lack the time and resources to identify and effectively prepare for a wider range of risk scenarios and, as a result, take longer to get the business back up and running after an unexpected incident.

Trends driving cyber activity in 2024

Cyber incidents (36% of overall responses) rank as the most important risk globally for the third year in a row – for the first time by a clear margin (5% points). Cyber incidents retains #2 position in South Africa.It is the top peril in 17 countries and regions, including Nigeria, Uganda, Kenya, Mauritius, Africa and the Middle East, Germany, India, Japan, the UK, and the USA. A data breach is seen as the most concerning cyber threat for Allianz Risk Barometer respondents (59%)followed by attacks on critical infrastructure and physical assets (53%). The recent increase in ransomware attacks – 2023 saw a worrying resurgence in activity, with insurance claims activity up by more than 50% compared with 2022 – ranks third (53%).

“Cyber criminals are exploring ways to use new technologies such as generative artificial intelligence (AI) to automate and accelerate attacks, creating more effective malware and phishing. The growing number of incidents caused by poor cyber security, in mobile devices in particular, a shortage of millions of cyber security professionals, and the threat facing smaller companies because of their reliance on IT outsourcing are also expected to drive cyber activity in 2024, “explains Scott Sayce, Global Head of Cyber, Allianz Commercial.

Business interruption and natural catastrophes

Despite an easing of post-pandemic supply chain disruption in 2023, Business interruption (31%) retains its position as the second biggest threat in the 2024 survey. Business interruption retains #3 position in South Africa and ranks in the top five risks in Ghana, Kenya, Senegal, Uganda and Africa and the Middle East. This result reflects the interconnectedness in an increasingly volatile global business environment, as well as a strong reliance on supply chains for critical products or services. Improving business continuity management, identifying supply chain bottlenecks, and developing alternative suppliers continue to be key risk management priorities for companies in 2024.

Natural catastrophes (26%) is one of the biggest movers at #3, up three positions. 2023 was a record-breaking year on several fronts. It was the hottest year since records began, while insured losses exceeded US$100bn for the fourth consecutive year, driven by the highest ever damage bill of US$60bn from severe thunderstorms. In South Africa, the impact of Natural catastrophes was particularly severe, propelling it from seventh to fourth place in the global ranking. The country experienced devastating floods that resulted in casualties and extensive damage to homes, businesses, and critical infrastructure.

Regional differences and risk risers and fallers

Climate change (18%) may be a non-mover year-on-year at #7 but is among the top three business risks in countries such as Brazil, Greece, Italy, Turkey, and Mexico. The report reveals that South Africa experienced a slight shift in risk perception, with Climate change dropping from the fourth to the seventh spot in 2023. Physical damage to corporate assets from more frequent and severe extreme weather events are a key threat. The utility, energy and industrial sectors are among the most exposed. In addition, net zero transition risks and liability risks are expected to increase in future as companies invest in new, largely untested low-carbon technologies to transform their business models.

Unsurprisingly, given ongoing conflicts in the Middle East and Ukraine, and tensions between China and the US, Political risks and violence (14%) is up to #8 from #10.The risk moved down one place to #6 in South Africa. 2024 is also a super-election year, where as much as 50% of the world’s population could go to the polls, including in Ghana, Mauritius, Senegal, South Africa, India, Russia, the US, and UK. Dissatisfaction with the potential outcomes, coupled with general economic uncertainty, the high cost of living, and growing disinformation fueled by social media, means societal polarization is expected to increase, triggering more social unrest in many countries.

However, there is some hope among Allianz Risk Barometer respondents that 2024 could see the wild economic ups and down experienced since the Covid-19 shock settle down, resulting in Macroeconomic developments (19%), falling to #5 from #3. Yet economic growth outlooks remain subdued – just over 2% globally in 2024, according to Allianz Research.

“But this lackluster growth is a necessary evil: highinflation rates will finally be a thing of the past,” says Ludovic Subran, Chief Economist at Allianz. “This will give central banks some room to maneuver – lower interest rates are likely in the secondhalf of the year. Not a second too late, as stimulus cannotbe expected from fiscal policy. A caveat is the considerable number of elections in 2024and the risk of further upheavals depending on certain outcomes.”

In a global context, the shortage of skilled workforce (12%) is seen as a lower risk than in 2023, dropping from #8 to #10. However, businesses in Central and Eastern Europe, the UK and Australia identify it as a top five business risk. Given there is still record low unemployment in many countries around the globe, companies are looking to fill more jobs than there are people available to fill them. IT or data experts are seen as the most challenging to find, making this issue a critical aspect in the fight against cyber-crime.

View the full global and country risk rankings

About the Allianz Risk Barometer

The Allianz Risk Barometer is an annual business risk ranking compiled by Allianz Group’s corporate insurer Allianz Commercial, together with other Allianz entities. It incorporates the views of 3,069 risk management experts in 92 countries and territories including CEOs, risk managers, brokers and insurance experts and is being published for the 13th time.

For further information please contact:

| Global: Hugo Kidston Global: Philipp Keirath |

Tel. +44 203 451 3891 Tel. +49 160 982 343 85 |

This email address is being protected from spambots. You need JavaScript enabled to view it. This email address is being protected from spambots. You need JavaScript enabled to view it. |

| Johannesburg: Lesiba Sethoga | Tel. +27 112 147 948 | This email address is being protected from spambots. You need JavaScript enabled to view it. |

| London: Ailsa Sayers | Tel. +44 203 451 3391 | This email address is being protected from spambots. You need JavaScript enabled to view it. |

| Madrid: Laura Llauradó | Tel. +34 660 999 650 | This email address is being protected from spambots. You need JavaScript enabled to view it. |

| Munich: Andrej Kornienko | Tel. +49 171 4787 382 | This email address is being protected from spambots. You need JavaScript enabled to view it. |

| New York: Jo-Anne Chasen | Tel. +1 917 826 2183 | This email address is being protected from spambots. You need JavaScript enabled to view it. |

| Paris: Florence Claret | Tel. +33 158 85 88 63 | This email address is being protected from spambots. You need JavaScript enabled to view it. |

| Rotterdam: Olivia Smith | Tel. +27 11 214 7928 | This email address is being protected from spambots. You need JavaScript enabled to view it. |

| Singapore: Shakun Raj | Tel. +65 6395 3817 | This email address is being protected from spambots. You need JavaScript enabled to view it. |

About Allianz Commercial

Allianz Commercial is the center of expertise and global line of Allianz Group for insuring mid-sized businesses, large enterprises and specialist risks. Among our customers are the world’s largest consumer brands, financial institutions and industry players, the global aviation and shipping industry as well as family-owned and medium enterprises which are the backbone of the economy. We also cover unique risks such as offshore wind parks, infrastructure projects or Hollywood film productions. Powered by the employees, financial strength, and network of the world’s #1 insurance brand, as ranked by Interbrand, we work together to help our customers prepare for what’s ahead: They trust us to provide a wide range of traditional and alternative risk transfer solutions, outstanding risk consulting and Multinational services, as well as seamless claims handling. The trade name Allianz Commercial brings together the large corporate insurance business of Allianz Global Corporate & Specialty (AGCS) and the commercial insurance business of national Allianz Property & Casualty entities serving mid-sized companies. We are present in over 200 countries and territories either through our own teams or the Allianz Group network and partners. In 2022, the integrated business of Allianz Commercial generated more than €19 billion gross premium globally.

These assessments are, as always, subject to the disclaimer provided below.

Cautionary note regarding forward-looking statements

This document includes forward-looking statements, such as prospects or expectations, that are based on management's current views and assumptions and subject to known and unknown risks and uncertainties. Actual results, performance figures, or events may differ significantly from those expressed or implied in such forward-looking statements.

Deviations may arise due to changes in factors including, but not limited to, the following: (i) the general economic and competitive situation in Allianz’s core business and core markets, (ii) the performance of financial markets (in particular market volatility, liquidity, and credit events), (iii) adverse publicity, regulatory actions or litigation with respect to the Allianz Group, other well-known companies and the financial services industry generally, (iv) the frequency and severity of insured loss events, including those resulting from natural catastrophes, and the development of loss expenses, (v) mortality and morbidity levels and trends, (vi) persistency levels, (vii) the extent of credit defaults, (viii) interest rate levels, (ix) currency exchange rates, most notably the EUR/USD exchange rate, (x) changes in laws and regulations, including tax regulations, (xi) the impact of acquisitions including related integration issues and reorganization measures, and (xii) the general competitive conditions that, in each individual case, apply at a local, regional, national, and/or global level. Many of these changes can be exacerbated by terrorist activities.

No duty to update

Allianz assumes no obligation to update any information or forward-looking statement contained herein, save for any information we are required to disclose by law.

Privacy Note

Allianz Commercial is committed to protecting your personal data. Find out more in our privacy statement.

Latest from

- Olive Oil Myths Debunked: Separating Fact from Fiction with African Gold

- Tony Kocke, Crafting Culinary Excellence at @Sandton Hotel

- The Showmax Roast of Minnie Dlamini – nothing mini about it!

- How to improve indoor air quality and breathe easier

- Unlocking the Terrible Two’s: Navigating the Journey of Autonomy and Exploration